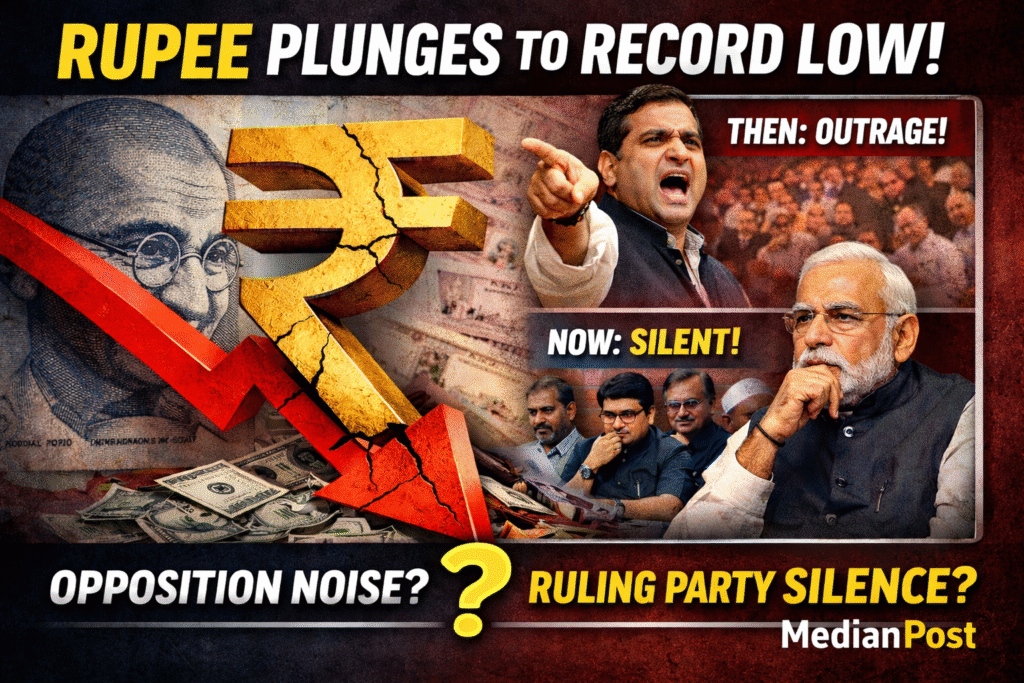

The Indian rupee has slipped to one of its weakest levels against the US dollar in recent times, raising serious concerns about the country’s economic stability. What stands out, however, is not just the falling currency but the silence of the ruling party, which once treated every dip in the rupee as a national crisis when it sat in the opposition.

The question is unavoidable: Why has the issue lost its urgency after coming to power?

When the Rupee Was a Political Weapon

A decade ago, when the rupee traded at much stronger levels than today, its decline was projected as proof of economic mismanagement. Press conferences were held, sharp statements were issued, and the government of the day was blamed for “destroying the economy.”

At that time, a falling rupee was portrayed as a direct reflection of poor governance.

In Power, a Sudden Silence

Today, the rupee is significantly weaker, yet the tone has changed. Instead of outrage, there is restraint. Instead of accountability, there are explanations.

Analysts point to three key reasons behind this silence:

- Blaming Global Factors

The government argues that a strong US dollar, high American interest rates, global uncertainty, and geopolitical tensions are responsible. While these factors are real, critics ask why the same logic was dismissed when the party was in opposition. - Controlled Narrative

The rupee’s fall is now framed as a “global phenomenon,” reducing its political impact. The issue rarely dominates headlines or prime-time debates. - Fear of Economic Spillover

A serious discussion on the rupee would inevitably raise uncomfortable questions about inflation, fuel prices, rising imports, and unemployment—issues with direct electoral consequences.

Why Is the Rupee Falling?

Beyond global pressures, domestic structural issues continue to weigh on the currency:

- A widening trade deficit

- Heavy dependence on crude oil imports

- Foreign investors pulling out amid uncertainty

- Sluggish manufacturing and export growth

Economists argue that without strong export growth and reduced import dependence, the rupee will remain under pressure.

How Long Will the Pressure Last?

If global markets stabilise and policy measures focus on boosting exports and attracting long-term investment, the rupee may recover marginally. However, in the short term, a strong rebound appears unlikely without meaningful economic reforms.

Closure

The rupee is more than just a currency—it is a reflection of economic confidence.

The real issue today is not merely why the rupee is falling, but why political standards change once power is secured.

What was once a “national crisis” has now become an inconvenient statistic.